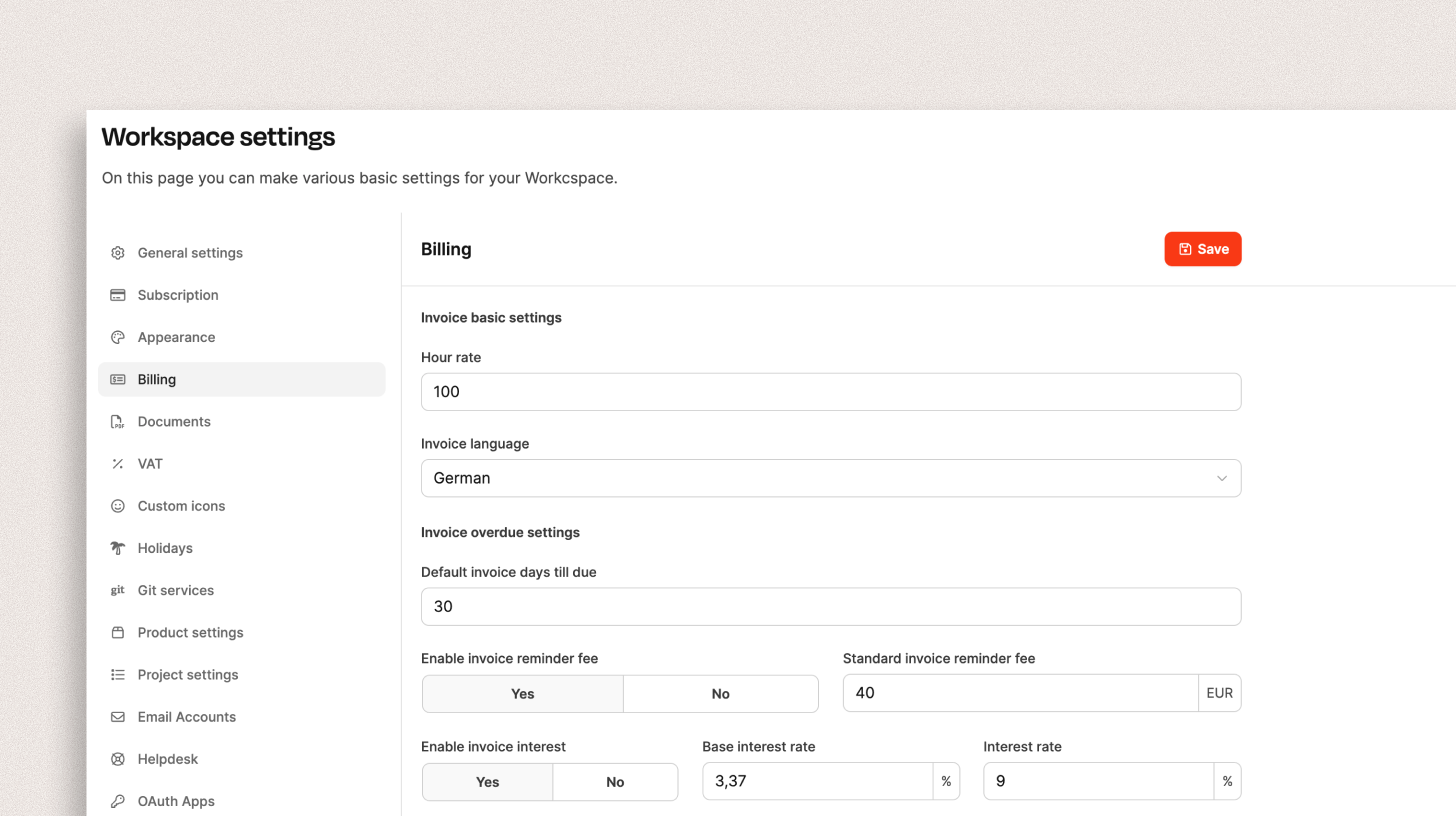

Found under Administration → Workspace Settings → Billing.

This section sets the main settings for invoicing, dunning processes, and interest calculation in the workspace. The values you set here are the default for all projects and organizations, but you can override them at the organization level. So, for a certain customer, you could, for example, choose not to charge dunning fees.

Adjust billing settings for specific organizations: Organization – Billing Settings

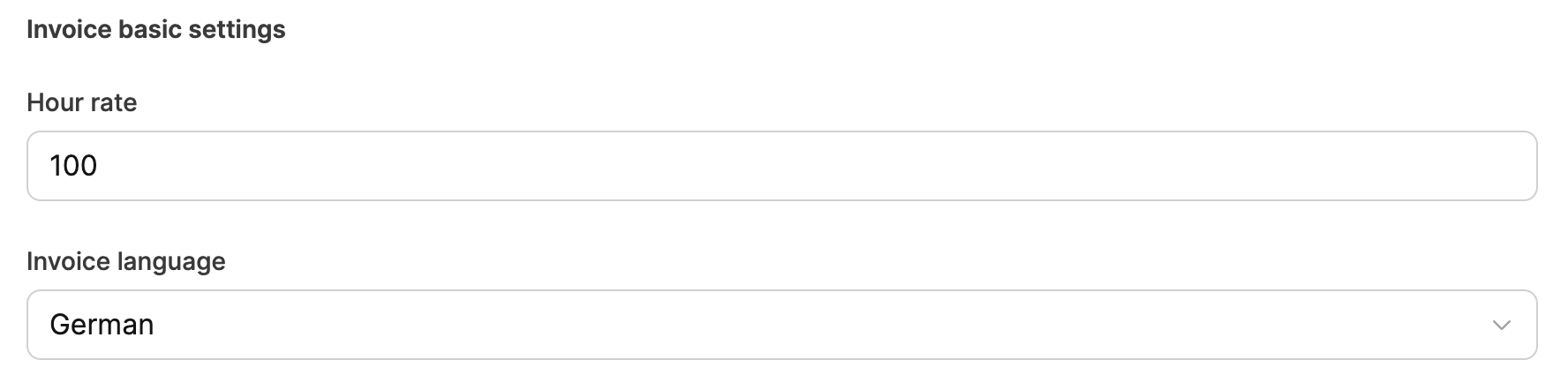

Here you set the general external hourly rate that will be set as the company default. Please note that you can set an individual hourly rate for each of your customers at the organization level. If you don't set an individual hourly rate for an organization, the standard hourly rate set here will be used.

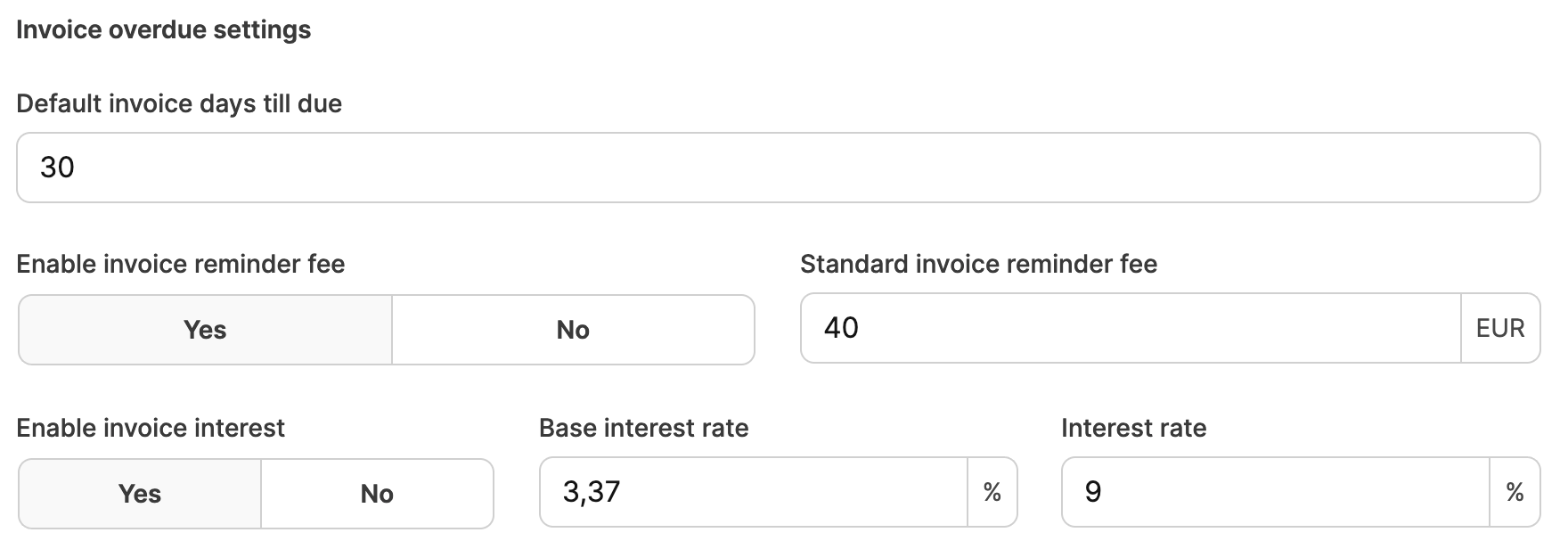

Invoice documents are based on text templates.

You can adjust these text templates for each language version (English and German) and select your preferred language version for each customer at the organization level. This is super handy if you have customers both in your own country and in English-speaking countries. In the workspace settings, you decide which language version should be used by default for invoice documents.

Here you can set what should happen by default if an invoice is overdue.

The “default payment term” in days defines when an invoice is considered overdue (e.g. 30 days). You can override this value at the organization level. So, for example, you can give certain customers a longer payment term if you want.

You can charge your customers reminder fees for overdue invoices. For B2B transactions in Germany and Austria, reminder fees of up to 40 euros are legally allowed (see § 288 (5) BGB). For other European countries, you have to enter the respective values manually.

You can adjust reminder fees at the organization level. This gives you the option to suspend fees for key customers so you don’t put important business relationships at risk.

If invoices aren't paid on time, you can charge default interest in addition to reminder fees. But you can't just set any interest rate you want.

For business customers in Germany, if an invoice isn’t paid on time, default interest of 9% above the base interest rate can be charged.

The current base interest rate is: 3.37%

Here’s an example of how to calculate default interest: A B2B customer buys goods worth 1,000 euros. Payment is overdue by 100 days after the payment deadline. With a base interest rate of 3.37%, the default interest rate is 12.37% (3.37% + 9%).

The formula for the calculation is:

Invoice amount x (base interest rate + 9%) x days overdue / 365 = late payment interest Example calculation: €1,000 x (3.37% + 9%) x 100 / 365 = €33.89

So the total amount including late payment interest comes to €1,033.89.

So if you want to charge late payment interest, just activate the Late Payment Interest radiobutton, enter the current base interest rate and the corresponding surcharge rate.

For countries outside Germany, the base interest rate has to be set manually.

Note: You can turn late payment interest on or off at organization level. This way you have the option to suspend the interest for key clients so you don't risk those important business relationships.

Adjust billing settings specific to your organization: Organization – Billing settings

If this option is enabled, when you create an invoice to a foreign country, VAT won't be shown. Instead, the tax liability is shifted to the recipient of the service (e.g. the foreign company).

This feature is important for companies that provide services or goods to business customers in other European countries. When the reverse charge procedure is activated, the invoice states that the VAT liability is carried by the recipient. This is mainly a common process in the EU that makes cross-border trade easier.

Regarding VAT

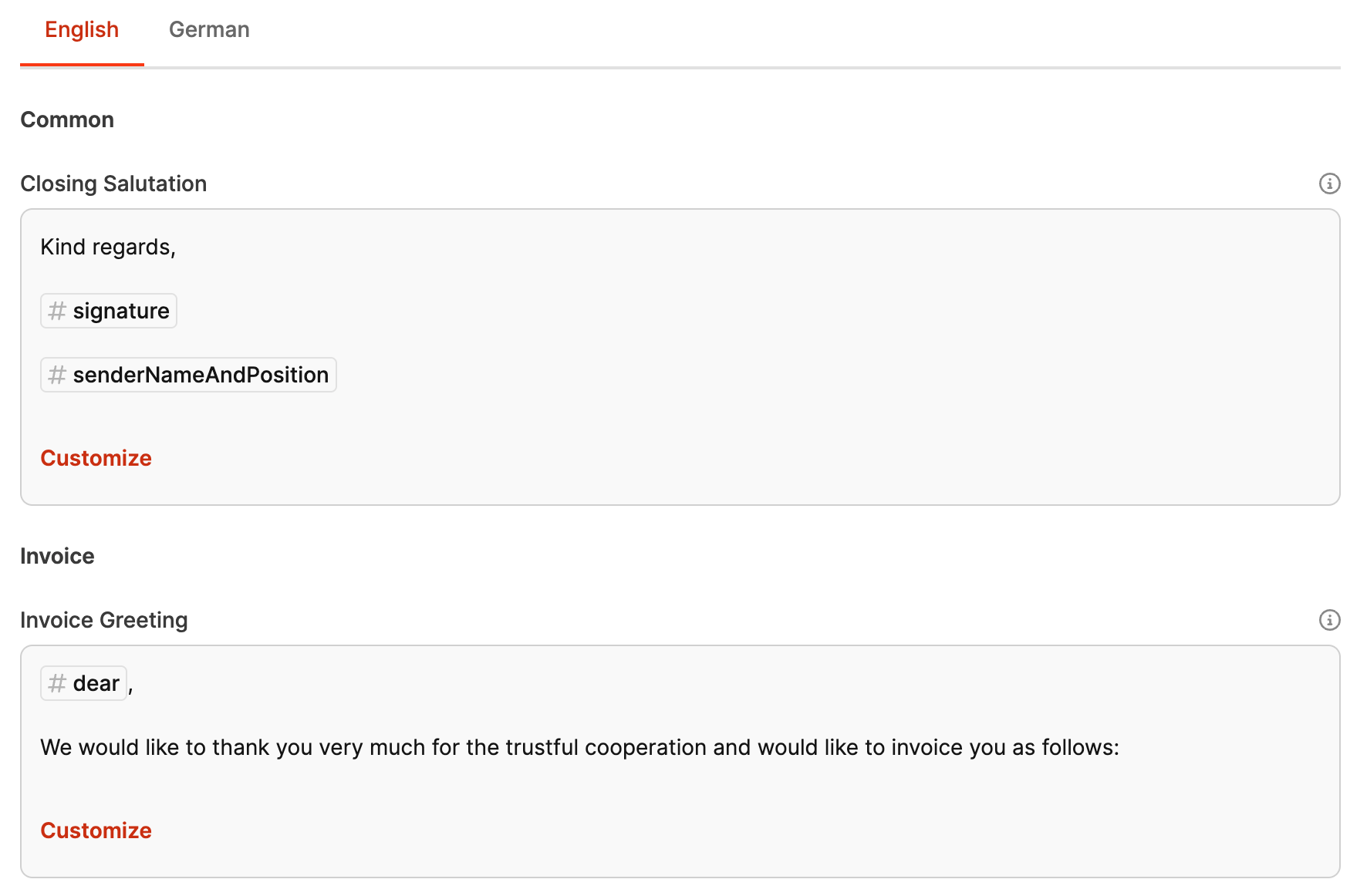

In Leadtime, you can customize greeting and closing phrases for invoices, reminders, and invoice cancellations. This system offers a three-level hierarchy to make things as flexible and customizable as possible:

So it makes sense to save some solid workspace-wide texts and then define exceptions for individual organizations.

The greeting and closing phrases defined at the workspace level apply by default to all projects and invoices within this workspace. They lay the foundation and serve as a universal guideline for all invoices, reminders, and cancellations.

If there are specific requirements for a particular organization, the greeting and closing phrases can be adjusted at the project level. These settings override the workspace default settings and only apply to invoices, reminders, and cancellations that are created for this organization. This option is especially useful when you need a different tone or a specific wording for individual clients.

Adjust billing settings for a specific organization: Organization – Billing Settings

At the individual invoice level, greeting and closing phrases can be adjusted again. These adjustments override both the organization and workspace settings. This is perfect when you want to add a one-off exception to the text for a single invoice.

Adjust billing settings for a single invoice: Receivables – Tab New

This flexible system lets companies customize their invoice and dunning texts. This way, you can:

Reach different customers with specific wording.

Take into account projects with their own requirements or target groups.

React to special situations with individual invoices.

By being able to customize, you not only create a more personal customer experience, but also help make your communication with business partners more professional and tailored.

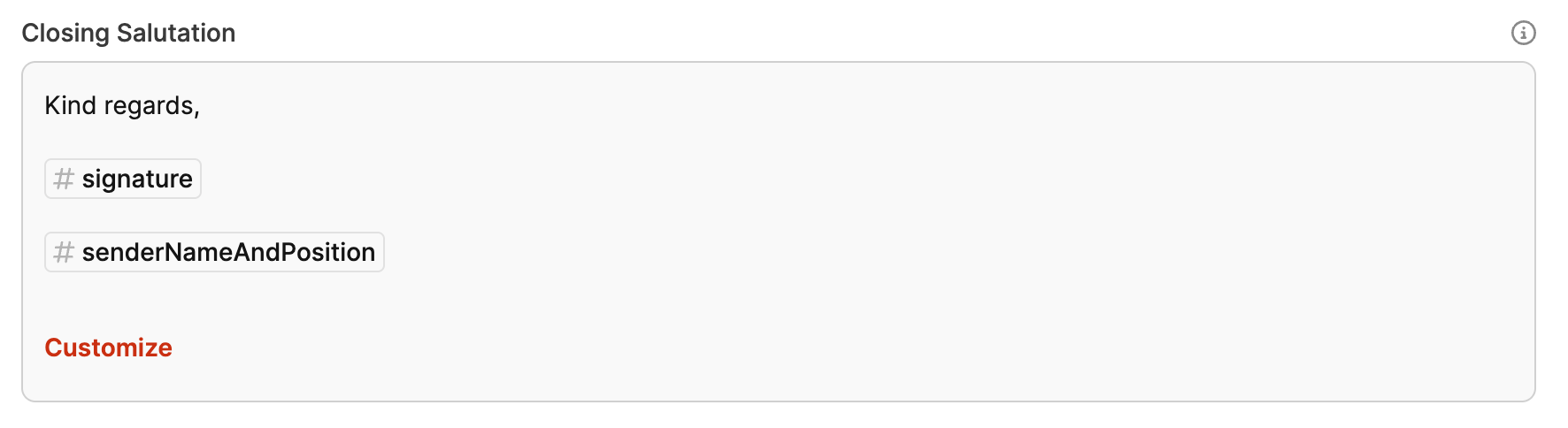

Closing formula: The text block for the closing formula in invoices. This is used by default on every invoice and can be customized here for the organization.

Invoice greeting: This is the text snippet for the greeting on invoices, which gets inserted automatically. You can change it to address your customer personally.

Invoice footer: Here you can add text that shows up as a footer on every invoice. This could include payment instructions and the appropriate bank account details.

Late fee warning: This text snippet is used when the first reminder is due. It tells the customer about any possible reminder fees or late interest.

Cancellation: This text is used for invoice cancellations.

First Reminder Greeting: This text is used in the first reminder to politely let the customer know that the payment deadline has been missed.

First Reminder Footer: This text appears at the end of the first reminder and explains what fees and interest will be due if the invoice remains unpaid.

Second Reminder Greeting: This text is for the second reminder. It tells the customer this is the final reminder.

Second Reminder Footer: The closing text of the second reminder, which lets the customer know about possible legal action if payment is still missing.

The following variables can be used in greeting and closing lines for invoices, reminders, and cancellations. The variables will automatically be replaced with the appropriate values.

Variable | Description |

Account Number | The account number for payments |

Due Date | The date by which the invoice has to be paid |

Reminder Penalty | The extra fee for reminders |

Interest Percent | The percent of interest on late payments |

Sender Name and Position | The name and position of the person sending the invoice |

Sender Name | The name of the person sending the invoice |

Sender Position | The position of the person sending the invoice |

Invoice Number | The unique ID of the invoice |

Project Name | The name of the project linked to the invoice |

Project Short Name | The short name of the project |

Client Company Name | The name of the client's company |

Contact Person | The main contact person for the invoice |

Invoice Netto | The net amount of the invoice before taxes and fees |

Invoice Total | The total amount of the invoice without taxes |

Full Total | The total amount including all taxes and fees |

Overdue Interest Percent | The percent of interest on overdue payments |

Overdue Interest Days | Number of days after which interest is charged on overdue payments |

Today's Date | The current date the invoice is made or viewed |

Dear Customer | Universal greeting based on the recipient's gender |