Value Added Tax (VAT)

You can find this under Administration → Workspace Settings → Value Added Tax

In this area, you decide which VAT rate gets used in your workspace. This setup makes sure invoices and quotes always use the right tax rate automatically.

Since VAT rates can change by law, Leadtime lets you set up multiple VAT periods.

This way, the system automatically knows when a new rate should apply.

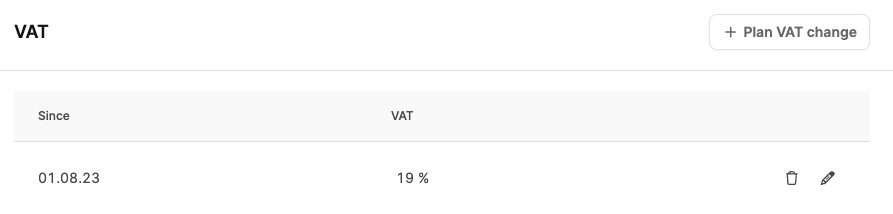

In the overview, you'll see all saved periods along with their start date (“Since”) and the corresponding tax rate.

Example:

01.08.2023 – 19%

from 19.10.2025 – 17% (new planned)

As soon as the new date comes, the new rate will automatically apply to all invoices and quotes created from that point on.

Documents that have already been issued keep their original tax rate.

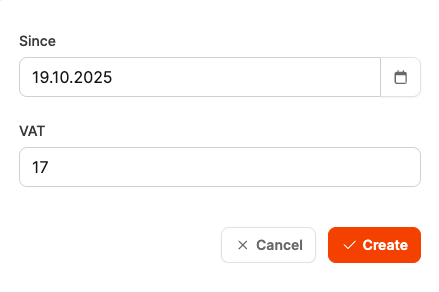

To add a new period:

Open Administration → Workspace Settings → VAT.

Click on Plan VAT change.

Pick the start date when the new rate should kick in.

Enter the new percentage.

Hit Create to save the change.

The new VAT rate will show up in the overview and become active automatically once the start date hits.

This way, your accounting always stays up to date and compliant – even if tax laws change in the future.